The Next Trillion Dollar Marketplace Will Put SKUs on Services

Why service marketplaces aren’t scaling and how they might get unstuck

The services industries should be home to massive marketplaces. They are enormous markets: annual freelance labor spend is 1.3T and home improvement spend is 600B in the US alone [1,2]. They have highly fragmented buyers and sellers that would benefit greatly from a better way to find and transact with each other.

So after thousands of attempts by some of the smartest teams in the world, where are they? You might argue that Uber is a service marketplace. But other than that, none of the ~10 US public marketplaces with market caps over $10B are in services. None of the top 10 private marketplaces are either [3,4].

This essay explores what is holding services marketplaces back, how they might get unstuck, and why this would produce some of the largest businesses in the world.

What is holding services marketplaces back?

You can buy a lightbulb in one click on Amazon, but hiring an electrician is still about as hard as it was 100 years ago. You don’t really know what you need, how long it will take, or how much it should cost, and you have to just start talking to electricians to find out.

Marketplaces dealing in physical things like products and properties solved this problem by bringing an incredible amount of information online. Everything they sell has a “SKU” - a unique identifier attached to descriptions, photos, reviews, and prices. In other words, they make everything they sell legible to customers in real time.

This was not a trivial undertaking. Amazon built its own classification system for products called ASIN (Amazon Standard ID number) and has used over 1 trillion of them [5]. Doordash pulled every menu onto its platform, first by literally driving around and picking them up, and later with the help of restaurants. Airbnb famously provided photography services to help bring new units of supply online for the first time.

This is much harder to do with services, because they are so diverse. Each one of those electrical projects (or web design or tutoring or almost every other service) is one of a kind, resisting categorization.

As I outlined in my last essay, marketplaces have evolved in four stages, which increasingly make it easier for buyers and sellers to transact, and usually get much bigger in the process:

Lead gen marketplaces help sellers list their good or services and help buyers discover them

Checkout marketplaces provide prices, terms, and reviews upfront, allowing for real time checkout

Managed marketplaces bear the risk of something going wrong with guarantees

Heavily managed marketplaces directly participate in distribution

Legibility is the great filter between Lead Gen and everything else. Without it, you can’t provide enough information for customers to be comfortable purchasing in real time, so the best you can do is make introductions between buyers and sellers and let them take it from there.

How services marketplaces can get unstuck

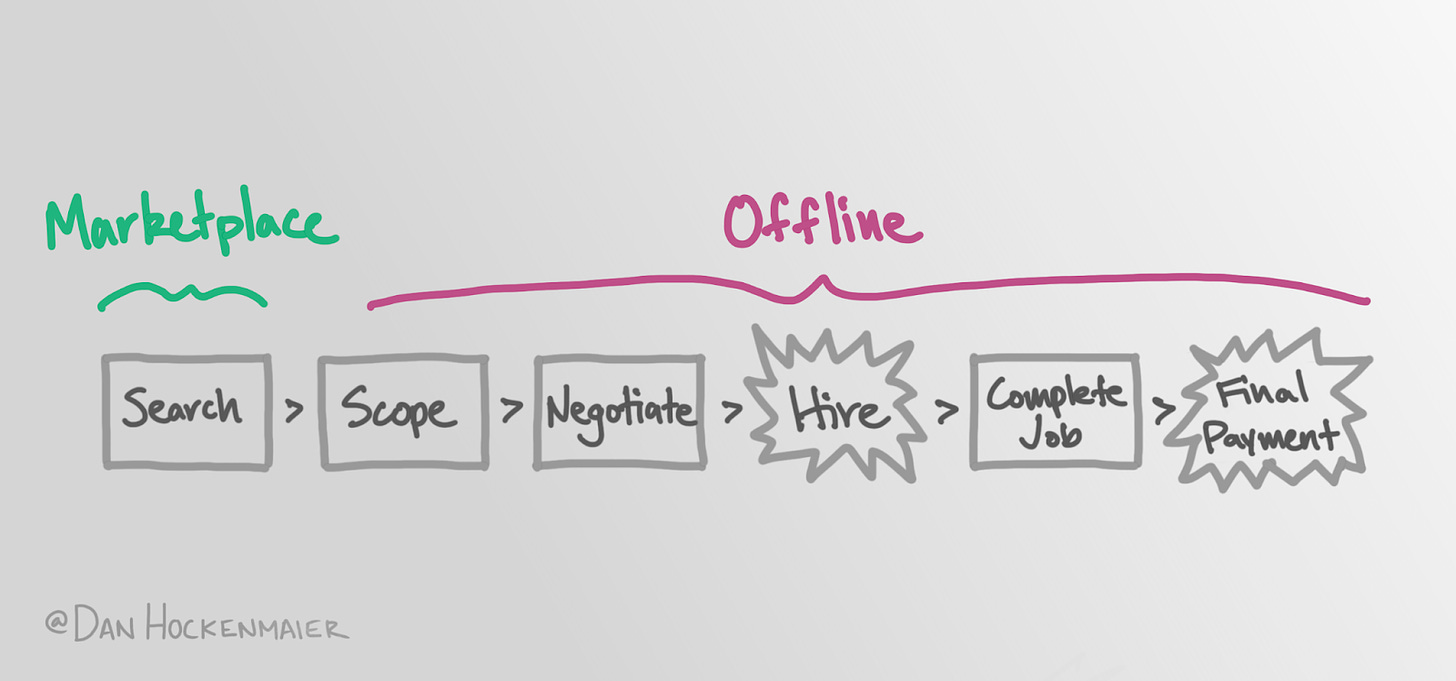

Purchasing services requires a lot of steps today: searching for suppliers, scoping the project, negotiating the price, making the hire, completing the job, and sending final payment.

Today, everything after the search happens offline, usually over multiple days or weeks. Ultimately, everything except for the job itself must happen online, in real time.

Evolving to a Checkout Marketplace requires enabling a customer to hire in real time by surfacing sufficient information about the project, the potential suppliers, and their quotes. Today, buyers get this information through a messy chain of messages, phone calls, and in person visits that is highly costly for both them and potential suppliers.

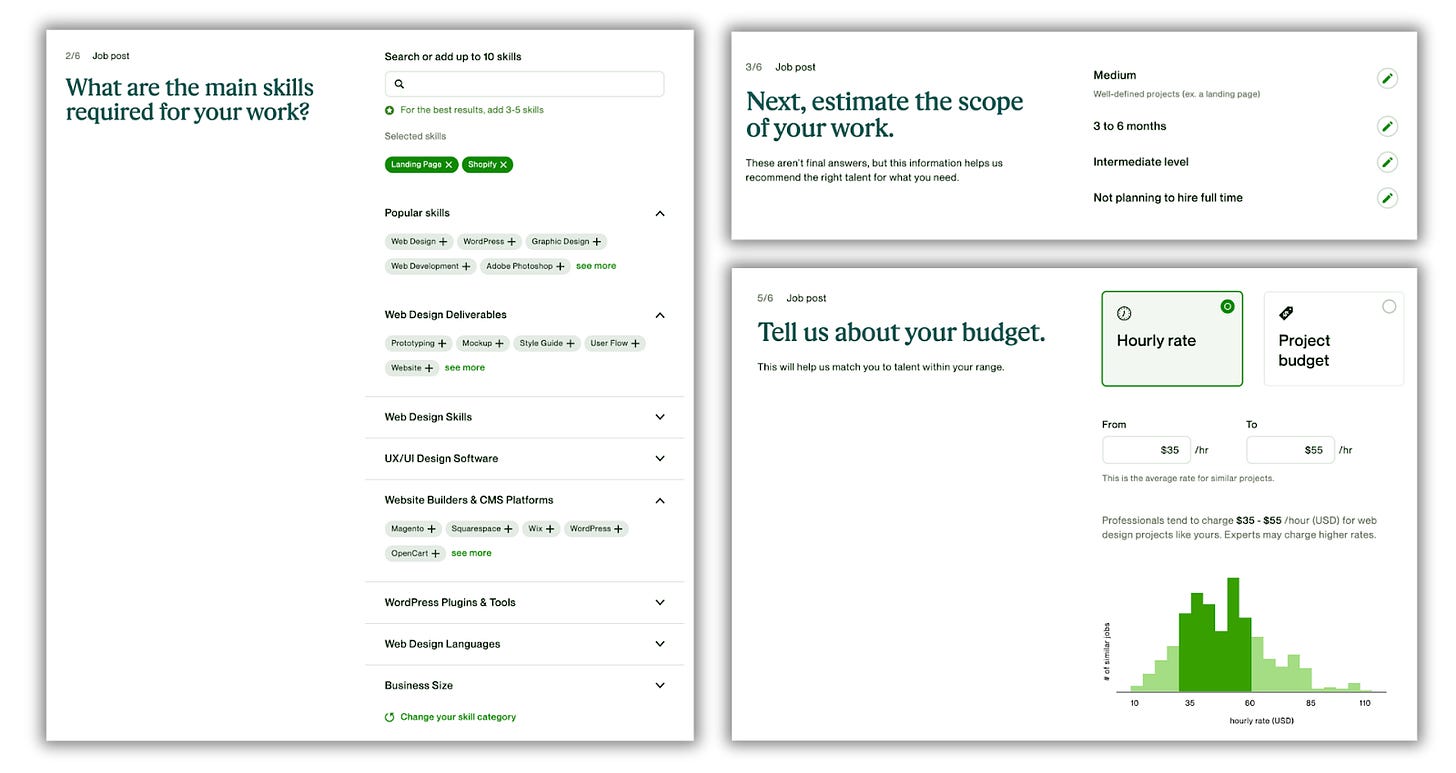

Many marketplaces are trying to streamline this process by collecting as much information from suppliers in advance about what they offer, how they price, and when they are available, and then collecting as much information from buyers in real time through a series of scoping questions. For example, here are a few of the intake questions to post a web design project on Upwork:

Usually, these flows essentially make the marketplace more effective at search, by filtering the potential set of suppliers that buyers can explore. Occasionally it starts to do some of the work of scoping and negotiating, by delivering a price range or the ability to schedule a meeting. But very rarely does it result in a “hire now” button that a customer will be comfortable clicking.

This is because the messy back and forth between buyers and sellers is a feature, not a bug. In most cases, the customer doesn’t actually know what they want, and talking to service providers is part of the process to figure it out. And exploring possible options is a decision tree with so many branches that you can’t write all of the if/then logic in advance.

What is really good at exploring a messy decision space in back and forth dialogue? Humans. And increasingly, LLMs trained on humans doing a lot of that in the past.

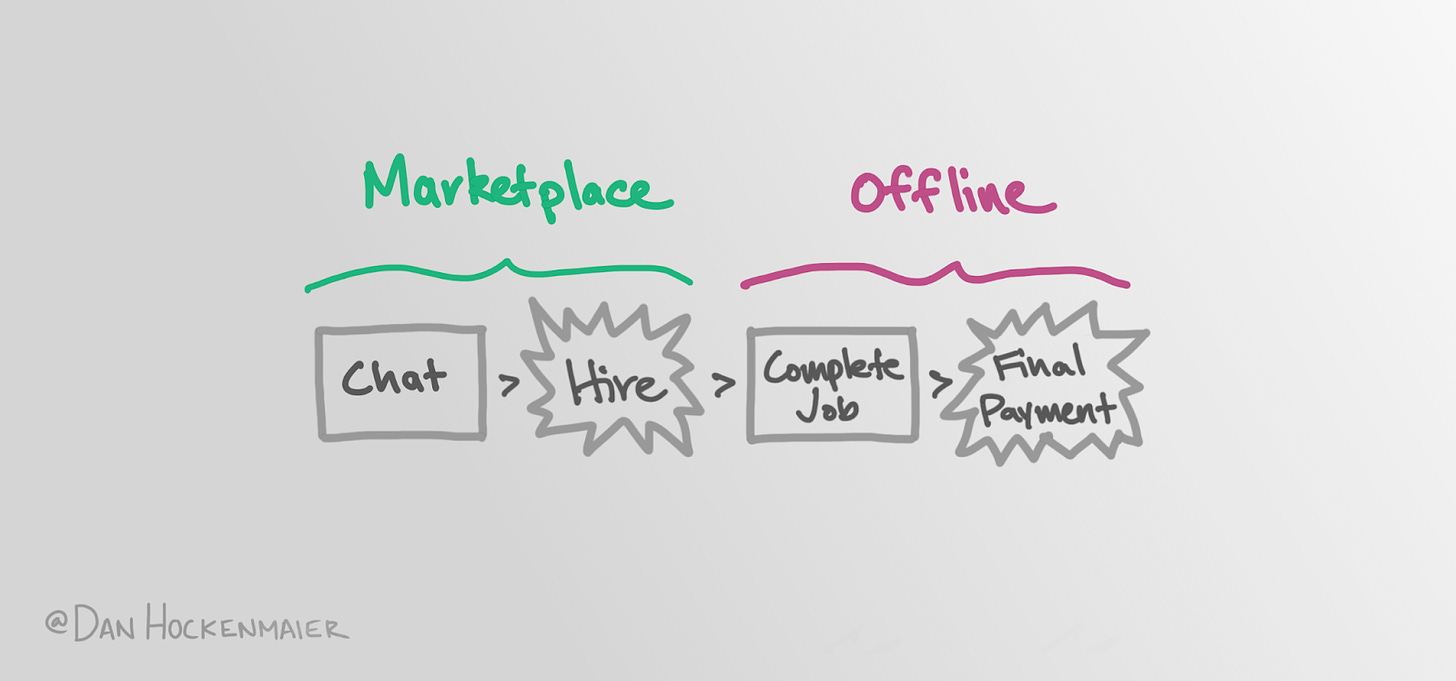

The solution is going to look more like that original messy back and forth, but instead of talking to a bunch of service providers, the customer will chat with an AI trained by the marketplace.

For that electrical project, you might start by taking a video of your backyard and the closest electrical panel with some voiceover about where you want to install outdoor lighting. Instead of all of the questions above about the web design project, you might just list a few example websites with the aesthetic you’re aiming for and jot down the functionality you need.

In both cases the AI will then understand what information is missing and start asking you for it, until it can translate it into a detailed scope. Using information from suppliers about which jobs they are interested in and how they price, the marketplace will then deliver supplier options and quotes in real time. The customer journey is starting to look much more manageable:

From there, it’s less of a leap to evolve to a Managed Marketplace. You just need to finish the job of putting SKUs on services, by providing the final price upfront.

As marketplaces get more data on which suppliers are hired, they can also build better feedback mechanisms for ratings and reviews. And as payments flow through their rails, they will see what the customer ultimately paid, not just the initial quote.

Information on supplier quality and pricing will allow marketplaces to deliver final prices before the job is completed. If the ultimate price is higher, the marketplace will make the supplier whole and eat the cost. But if it is lower, the marketplace will pocket it. Customers are likely to be willing to pay a small premium for the assurance that their price is final, giving marketplaces some buffer to play with.

The customer journey has now evolved to its final form:

How this will create some of the largest businesses in the world

If you dig into the metrics of most services marketplaces, you quickly see two things: a high percentage of traffic coming from paid channels and SEO, and low retention rates which limit customer LTV and constrain their ability to acquire more.

That is because there is one step in the customer journey we haven’t talked about: before customers search on lead gen marketplaces, they usually conduct a Meta Search, using Google (and friends and family) to figure out their options. This means the marketplace has to try to re-acquire most transactions.

Every mega successful marketplace becomes the default place that customers begin their search, bypassing aggregators like Google. The first place that most of Amazon’s customers search for a product is Amazon. This transforms them from a customer acquisition arbitrage business into a self-perpetuating flywheel that eats market share for breakfast.

The only way to become the default is to deliver a better experience so reliably that it becomes clear it is not worth the time to start anywhere else.

A better experience mostly means selection, value and convenience. You can’t beat Google at selection, because they have an index of the whole internet, including you. You can’t beat them on value, because if anything your commission drives up a seller’s cost and ends up in the price the customer pays. So you must win on convenience, and you must win by a lot.

Services marketplaces aren’t doing that today, but there are two ingredients that would enable it.

First, they must have enough training data to automate the experience as we described above. Once they can reliably deliver a “hire now” button, it will be blindingly obvious that this is better than Google. It’s the same thing that has happened in other industries: if you can order a meal in a couple clicks on Doordash, why would you start by searching for restaurants on Google?

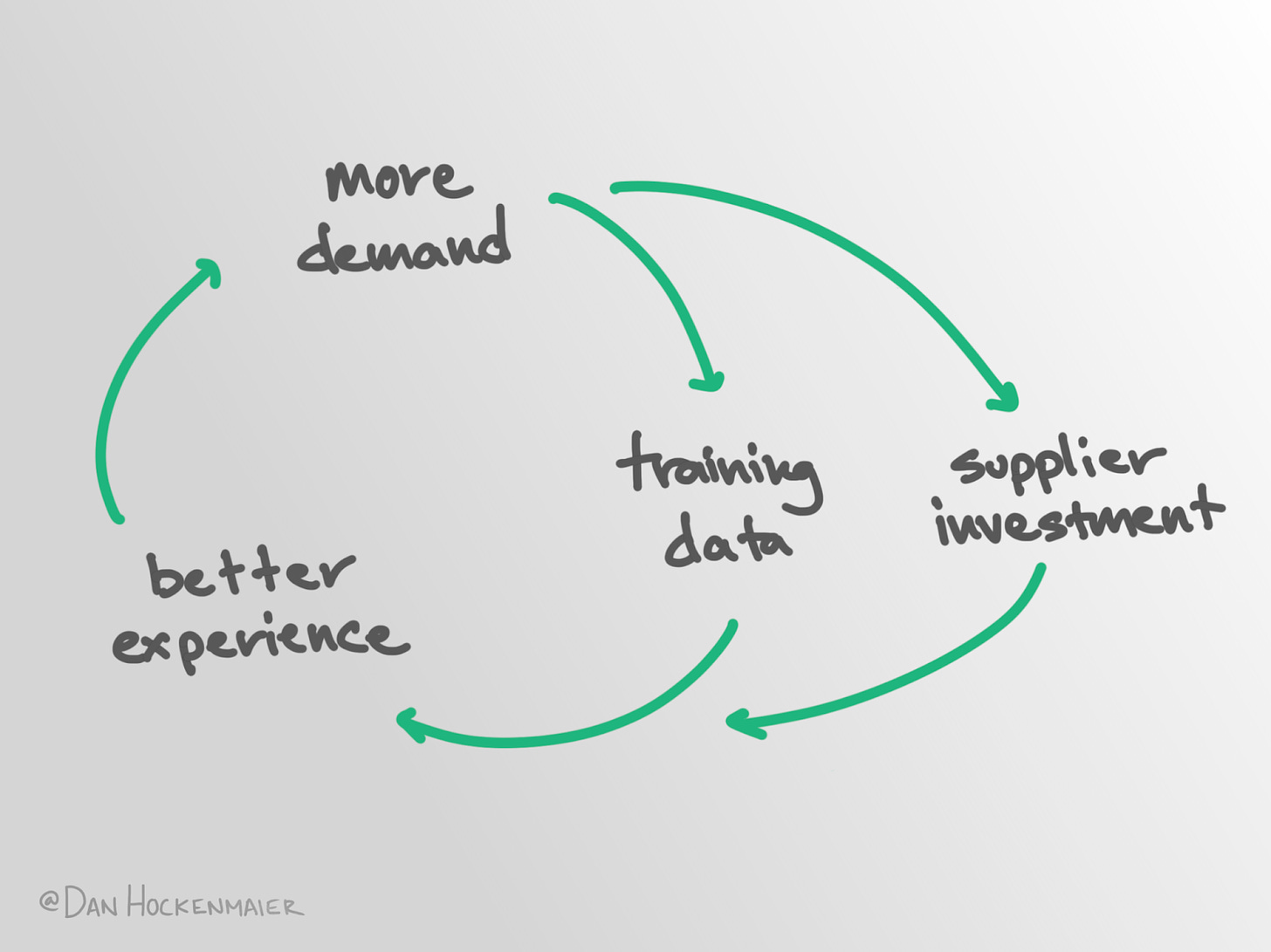

Second, they must have buy-in from suppliers to help them follow through on a great experience. Moving to real-time accomplishes this as well.

To suppliers, Lead Gen marketplaces are roughly interchangeable with other channels sending them leads, including ads or referrals from past clients. Their incentive is to just use whatever is cheapest, and try to disintermediate and pull customers into their own workflow whenever they can.

But when a marketplace delivers transactions instead of leads, it is now a new workflow that doesn't require spending time and money to vet and negotiate with customers. As they receive more demand, suppliers are incentivized to improve their performance on the marketplace, by integrating it into their workflows, creating the most up to date services offerings and prices, and delivering the most responsive service.

Instead of a leaky funnel, services marketplaces that evolve to real time transactions will have a flywheel powering a better and better customer experience to aggregate demand:

Rearranging an industry in your favor

If you are thinking that the services industries have other issues we haven’t addressed, you are correct.

There are two in particular. First, relationships in services are often monogamous: customers find a supplier they like and stick with them. Because the primary role of a marketplace is helping create new matches, this reduces their potential. Second, purchases are often infrequent, making it hard to create a habit and be top of mind when customers need you.

Both of these are real handicaps, but they are also mostly downstream of the legibility problem and will get much better when it is solved.

Monogamous behavior is mostly a consumer response to high transaction cost. Even if you don’t love the plumber who helped you last time, you’re still more likely to hire them the next time to avoid having to spend hours chasing down three new ones to see who is best. If a marketplace removes this cost, customers are going to start picking whoever is best for their current job, right now.

Solving legibility would also grow the market by a lot, especially for smaller jobs. For services like small repairs, personal assistance, or quick freelancing jobs, the cost of finding help is often higher than the price for the service itself, and removing that cost will increase demand substantially. These markets look a lot like taxis before Uber.

Most importantly, it would enable marketplaces to cover a broader range of services. Today, the only way to create a highly convenient offering is to custom build an entire experience around a narrow vertical. This has created businesses that work in their niche, but struggle to continue to scale, like Care.com and Rover. The ability to deliver a great experience across hundreds of categories will finally create the high frequency that all of the largest marketplaces have.

Predictions

The ability to cover many categories, in a rapidly expanding market, with a flywheel that continually improves the customer experience will create monster marketplaces. Three thoughts on how this may play out:

1. Low trust, low complexity services will go first

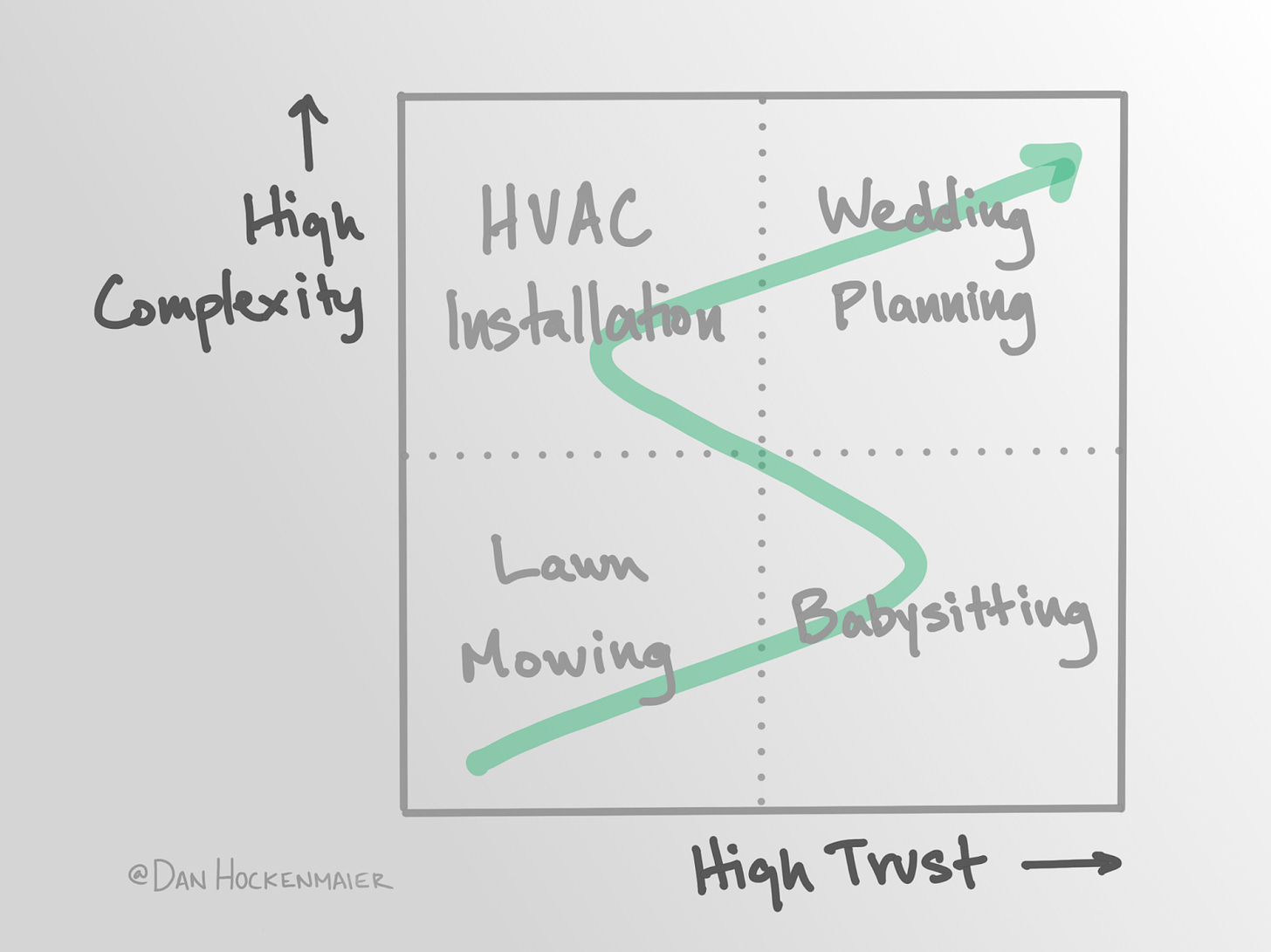

There are two dimensions that make it harder for customers to press the “hire now” button, and they will determine the order in which industries tip.

The first is the complexity of the job. It’s simply a lot harder to scope and price an HVAC installation in real time than a house cleaning. Solving this is mostly about sufficient data and ability to parse it, and the progress on these dimensions is astonishing. As models go multi-modal, we’re likely to see a step-change improvement, because AI can parse a lot of information from videos and photos that the customer doesn’t really understand or know how to communicate.

The second is the level of trust a customer needs to have in the specific person completing the job. This is a different kind of information problem, primarily requiring reliable reviews and background information.

It seems that high trust, high complexity services may be stuck for a while in a world where a marketplace can deliver initial meetings, but not hires. However, people now buy cars online without driving them, and Airbnb got people comfortable with strangers staying in their homes. So it’s not clear to me that there is some fundamental blocker on either of these dimensions.

I expect categories will tip in roughly this order, informed in part by the fact that we’re already starting to see wins in the bottom two quadrants:

2. The first big winners will evolve out of the current lead gen marketplaces

While they have low penetration of their massive industries, the leading services marketplaces are already enabling millions of transactions. Data from messages, quotes, profiles, and uploaded photo and video will give them a big headstart in automating the process.

Some marketplaces are already actively working toward this vision. For example, here is a quote from a Thumbtack fundraising announcement: “We built a self-serve system used by our pros to capture billions of individual preferences across hundreds of categories so that we could generate quotes programmatically with the same fidelity that pros could manually.” [6]

Thumbtack already allows customers to instantly book services for less complex projects like TV mounting, or book an appointment to get a quote for more complex ones like painting [7]. Knowing the ambition of that team, I expect there is much more coming.

Who might be well-positioned to do the same in freelancing, or education, or healthcare?

3. This will pave the way for vertical integration

As we’ve seen in industries like e-commerce and food delivery, the trend is to take on more and more of the work that suppliers do to improve the quality and reduce the variance in the customer experience and better aggregate demand.

For tasks in which customers care a lot about the creativity of an individual supplier like wedding photography or architecture, it will be harder to vertically integrate because customers are looking for the unique vision of individual suppliers. (I wrote more about this here).

But in cases where the customer simply wants the job done like cleaning and appliance repair, we’re likely to see vertically integrated models win over the long term. Early attempts at this such as Handy failed because they had essentially the same cost structure as offline service providers, making it difficult to scale at venture pace without burning a lot of money. But if you simultaneously wipe out a large percentage of back office costs by automating transactions and drive up customer retention through a better experience, this becomes more feasible.

And finally, fully digital tasks like web design and online tutoring are likely to be solved entirely by AI. If the model can grok the task well enough to fully scope and price it, it can probably also just execute it.

Credits

Thank you to Casey Winters, Chen Peng, Chris Erickson, Forrest Funnell, Marco Zappacosta, and Zach Grannis for their feedback on this essay.

Sources

[1] Freelance Forward, 2022 Report

[2] Improving America’s Housing

[3] Top public US marketplace businesses with market caps >$10B at publishing: Amazon, Walmart, Uber, Airbnb, Doordash, Ebay, Expedia, Zillow, Etsy

[4] A16Z Marketplace 100; top 10 private marketplace businesses: Instacart, Valve, Viagogo, SeatGeek, Turo, StockX, RockAuto, GOAT, Whatnot, Evolve. The first service marketplace on this list is StyleSeat, at #19.

[6] Blood, sweat, tears and fundraising

[7] Thumbtack Launches Instant Book to Make Hiring Pros Even Easier

Such a great piece Dan. Thanks for going so deep in this area. Just started a marketplace in the hotel space and so many areas run very true. Look forward to exploring deeper.

Thanks Dan -- such a thought-provoking piece. You covered it re: managed marketplaces, but reputation being attached is such a big unlock for (real and perceived) transaction costs IMO. When more of the relationship happens on the platform, I almost have a feeling that the platform has my back (think Aircover from AirBnb). It makes me more willing to take risks and try new providers