LLMs vs. Marketplaces

Which marketplaces will probably win the battle with LLMs, which will probably lose, and what any marketplace can do to improve its odds.

LLMs are on a collision course with marketplaces. The Verge calls it The DoorDash Problem:

So what, exactly, is the DoorDash problem? It’s what happens when an AI interface gets between a service provider, like DoorDash, and you, who might send an AI to go order a sandwich from the internet instead of using apps and websites yourself.

Marketplaces have always had to pay a lot for new customer acquisition, but they then pay it back through an annuity of repeat transactions that they get for free.

If ChatGPT (which I’ll use as a stand-in for whichever LLM wins) becomes the place customers start every search, that’s a big problem. Marketplaces would have to spend much more to acquire each transaction individually, and they would also lose out on all of the other things they do with customer engagement, like ads and upsells.

It’s true that this will happen to some marketplaces. But many will be just fine (and ironically DoorDash is one of them).

This essay unpacks how defensible each type of marketplace is, and what they can do to improve their odds.

Three factors will matter the most in determining whether customers decide to start their search on an LLM or directly on a marketplace:

Difficulty of supply aggregation

Degree of marketplace management

Nature of customer engagement

1. Difficulty of supply aggregation

A marketplace’s first and most important job is to aggregate supply. OpenAI hasn’t tried to do this yet, but they will soon. They’ll allow suppliers to create accounts, similar to how every local business ultimately created a business profile on Google.

But in many industries, it will be very difficult to match the supply of the leading marketplaces.

The hardest supply to aggregate is fragmented (many small suppliers), heterogeneous (each offering unique things), and illegible1 (difficult to understand service offerings, availability, quality, price).

Matching Expedia’s supply of hotels is not very hard. Hotels are large businesses with standardized offerings and teams of people whose job it is to explore new growth channels like LLMs.

Matching Airbnb is much harder. It’s taken them many years and billions of dollars to aggregate millions of individual homes and rooms. They’ve had to invest heavily to make amenities, photos and quality legible to customers.

Comprehensive supply is one key to keeping customers coming back. Show someone you don’t have what they’re looking for too many times, and they’ll stop trying.

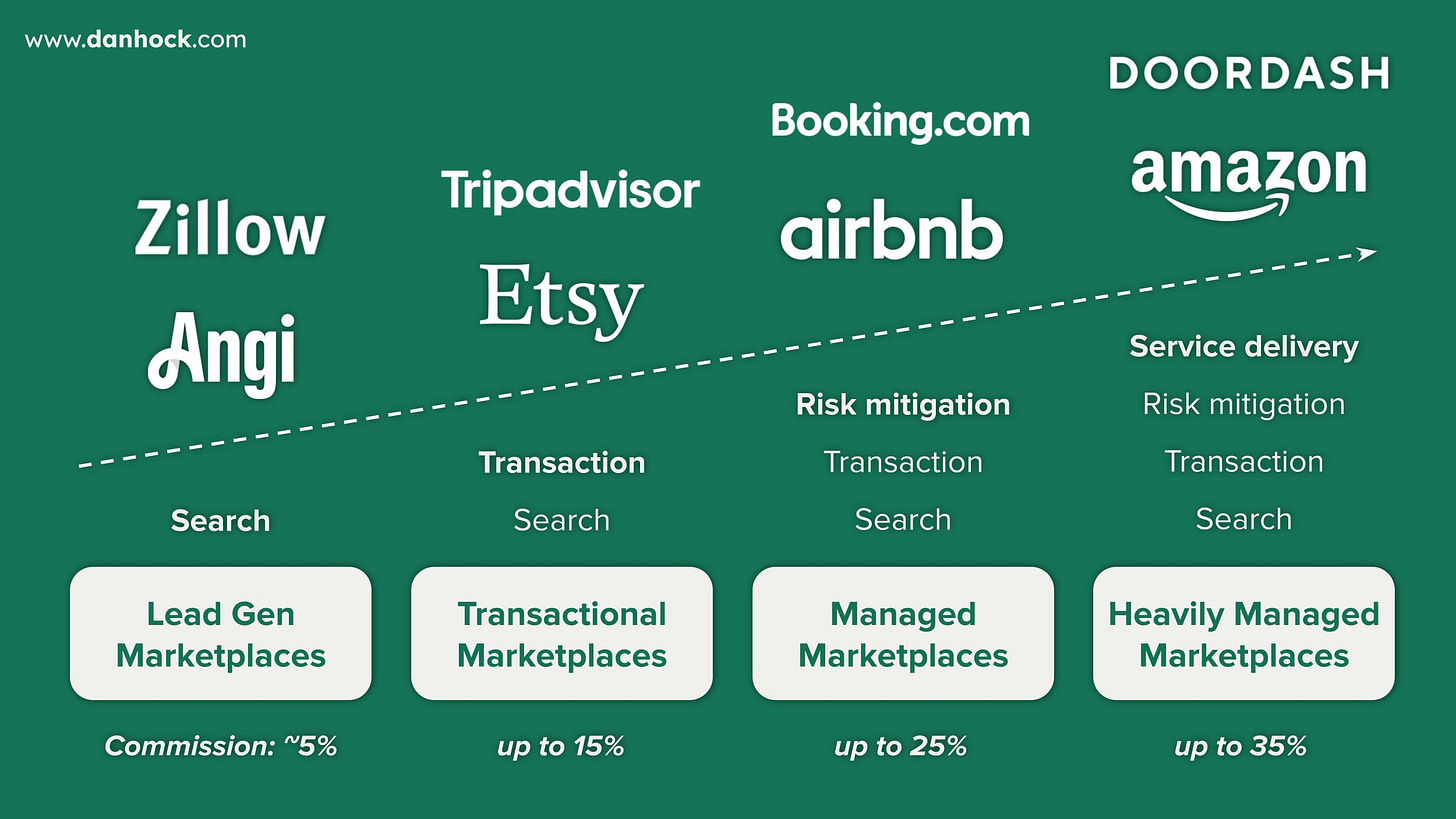

2. Degree of management

The second thing marketplaces do is a series of jobs to help customers find and purchase from suppliers. There are four types of jobs:

Searching for suppliers

Facilitating the transaction

Managing risk

Managing service delivery itself

The number of these jobs a marketplace does determines how heavily managed it is (more on this here). The further to the right, the more defensible it will be.

Google has long been unsatisfied with just customer acquisition dollars, and has been trying to eat the entire marketplace profit pool.

Google Flights, Google Shopping, and Google Local were an effort to do the “searching for suppliers” part of the marketplace job directly in the SERP.

And to an extent, it worked. Google already takes most of the profit away from pure lead gen marketplaces, making them pretty bad businesses.

ChatGPT is just another aggregation layer like Google, but with two big differences:

It makes search much better by understanding intent, enabling multi-turn (back and forth) querying, and parsing and aggregating information across many sources

It can actually transact on your behalf, which we’re starting to see take shape with initiatives like Instant Checkout

Superior search plus the ability to transact will allow ChatGPT to push further into the marketplace stack than Google, and do everything a transactional marketplace can.

But is ChatGPT going to try to do the final two jobs of managing risk or managing service delivery itself? Are they going to start accepting returns? Offering financing terms to buyers? Are they going to manage their own drivers or build their own logistics network? That seems very unlikely.

The more value a marketplace’s customers get from those final two jobs, the more ChatGPT will rely on them to deliver the kind of experience customers expect. For DoorDash, even assuming the LLM could aggregate all of the restaurants they have (very hard), customers want to know that their food will get to them on time, still warm, not tampered with, and that they get their money back if any of those aren’t true.

Together, difficulty of supply aggregation and degree of management predict whether LLMs need a marketplace at all.

The most dangerous quadrant below is the bottom left. Marketplaces that (1) are not managed and (2) have supply that is easy to aggregate could be replaced entirely by an LLM.

The upper left is also dangerous, because the LLM can provide the same service with at least a subset of the marketplace’s supply, starting to unravel its network effect.

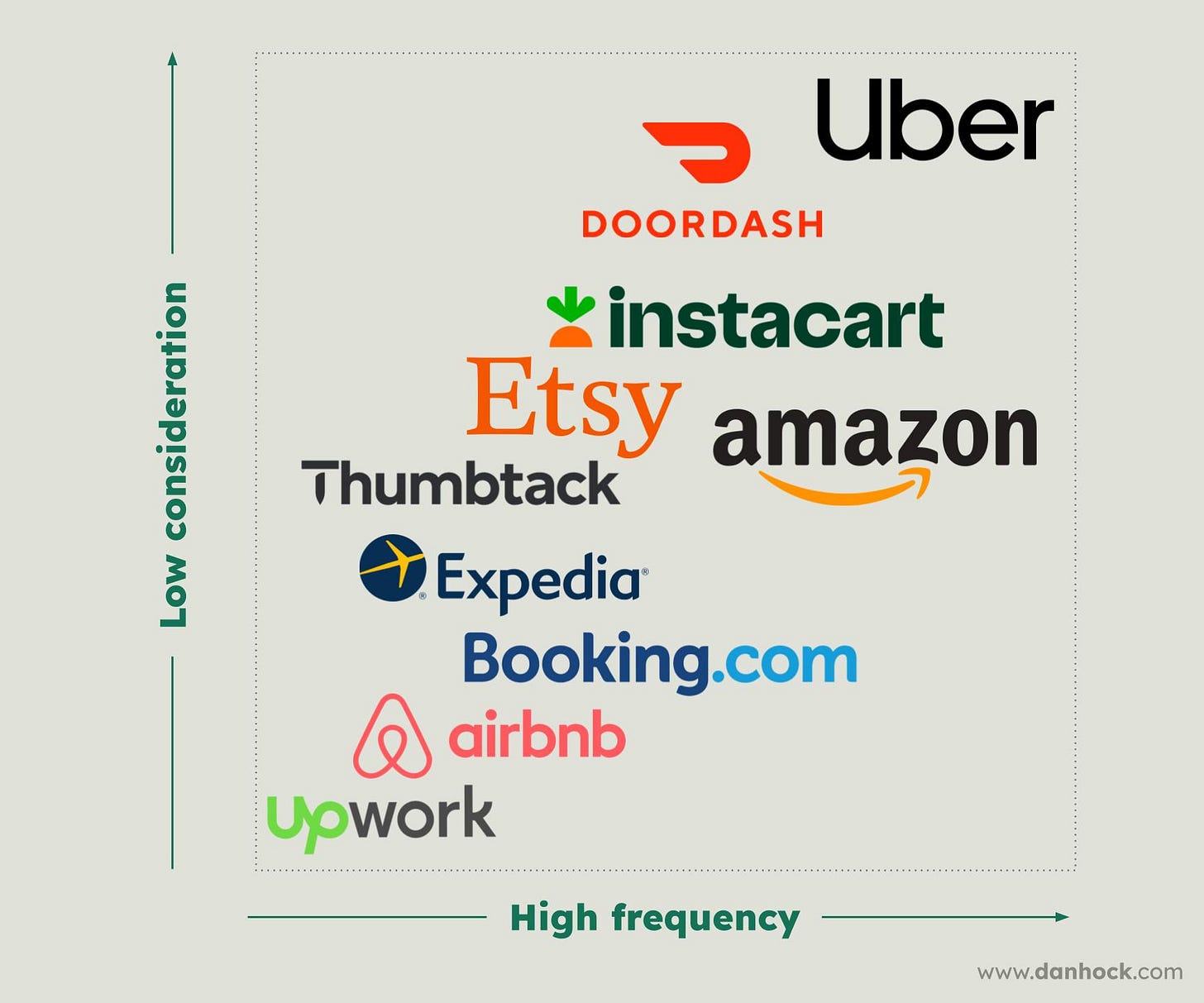

3. Nature of customer engagement

Managed marketplaces (the two right quadrants above) aren’t at risk of being replaced outright. But they’re still at risk of having to pay for more transactions than they do today if customers begin to start more of their searches in an LLM. How often that happens will be driven by the nature of customer engagement, on two dimensions:

Transaction frequency

The more frequently the customer uses a marketplace, the more likely they are to go directly to that marketplace instead of a general-purpose tool like Google or an LLM.

When you use a product a lot (e.g. take rides with Uber) you’re more likely to remember its name, more likely to have the app on your phone, more likely to be accustomed to their UI, more likely to join their rewards program. High frequency marketplaces just have deeper brand hooks into the customer and usually have much better retention rates as a result.

Purchase consideration

The second dimension is how heavily considered the purchase is.

Planning a vacation or buying new skis usually requires a bunch of research on which options are best and time spent comparing brands, options, and prices. This is an ideal LLM use case. Even if someone is a loyal customer of a marketplace, they’re likely to start their search on an LLM for high consideration purchases.

The marketplaces least likely to lose transactions are high frequency, low consideration use cases like ride sharing. And the most exposed are low frequency, high consideration like travel.

How different industries will play out

The result is a spectrum of outcomes, all the way from extinction on the left to business as usual on the right.

Hotel marketplaces (e.g. Expedia, TripAdvisor) will fare very poorly. The current winners rely heavily on paid and organic search traffic, and as that shifts to LLMs, the LLMs are likely to initially take much more of their economics, and ultimately replace them entirely.

Local services marketplaces (e.g. Thumbtack, Angi) already have relatively low repeat rates and are trying to address this by going deeper into home maintenance and planning tools. However this is a core LLM use case and customers are likely to start many of their searches there, shifting even more of the economics away from the marketplaces. The way out is to fully rebuild the experience around AI and become managed marketplaces.

Home rental marketplaces (e.g. Airbnb, Booking) will do better than hotels, because supply is significantly harder to aggregate and make legible. But they are still at risk of losing economics on a lot of transactions because they are often tied to high consideration travel planning use cases.

E-commerce marketplaces (e.g. Amazon, Walmart) will overall do well because they are heavily managed (creating significant speed and convenience benefits for customers) and have long tail, fragmented supply. But they will start to lose economics on more heavily considered purchases, unless they can successfully go AI-first in their experience and are willing to give up ad revenue, which we discuss more later.

Food delivery marketplaces (e.g. DoorDash, Eats) will be mostly unaffected. They may lose some transactions tied to heavier planning occasions like business and events, but these aren’t very common. The “DoorDash problem” is not really a problem for DoorDash.

Ride sharing marketplaces (e.g. Uber, Lyft) will be almost entirely unaffected by LLMs because they are heavily managed and have very frequent, low consideration purchases. This is good because they need to spend their time focusing on the other big AI disruption coming in the form of driverless cars.

What marketplaces should do now

It will take multiple years for LLMs to march through each industry, particularly now that ChatGPT and Gemini are going to have to spend a lot of their energy competing with each other. Here is what marketplaces can do in the meantime to strengthen their position:

1. Do things that LLMs won’t

This includes underwriting the transaction with returns, guarantees, and financial terms, and it includes participating in physical service delivery, like building your own fleet or logistics network. All of these reduce gross margins, add operational complexity, and take a long time to get right. But that is precisely why LLMs won’t follow.

Similarly, supply that is difficult for LLMs to aggregate is a defensive wedge. Amazon went direct to factories to create a whole new category of supply. DoorDash rolled out the red carpet with custom deals and heavy support to get the best restaurants on their network. This is the kind of thing marketplaces should be pursuing.

2. Build AI search natively

Particularly for high consideration use cases, marketplaces must stay as close to the LLMs on search experience as they can, so that other advantages can continue to tip the experience in their favor.

Marketplaces likely do not need to be first, but they do need to be building talent and capability, and watching closely to be ready to fast follow as great new experiences are created in their industry.

3. If you have high market share, play hardball

Michael Morton (analyst at MoffettNathanson) was interviewed by Ben Thompson of Stratechery in November:

I think Amazon should take their time with ChatGPT, because it’s important to underline that ChatGPT needs Amazon more than Amazon needs ChatGPT.

If you’re ChatGPT and you’re trying to present an e-commerce offering to the consumer, you can’t do it without 50% of the market. Amazon is half the e-commerce market, they have the world’s inventory and the world’s distribution network.

In any industry with a dominant leader, OpenAI faces the same conundrum. Smaller players like Walmart have an incentive to partner to try to take share, and they will be able to shave off incremental transactions. But if the largest players hold out, LLMs just can’t create a consumer offering that is very compelling.

Marketplaces with high market share have quite a lot of leverage. They should hold out entirely, or wait for great economics.2 And if they do partner, they should retain optionality by holding back their most valuable data, including supplier and product information and conversion and repeat rates.

4. Don’t get greedy

Amazon currently has a lot of margin that is looking like ChatGPT’s opportunity. Ads generate $60B in revenue and contribute ~all of the profit for the e-commerce business.

But it has also made the consumer experience much worse. More than half of product impressions are promoted, and it takes a long time to find what you’re looking for. They could get away with it prior to LLMs, but now it’s a huge vulnerability because the experience of getting the best product recommendation right away in ChatGPT is just so much better.

Amazon is one of the most egregious examples, but many mature marketplaces have been willing to degrade the customer experience in favor of monetization. If ads or upsells are making search worse, or if commission is too high and increasing prices for customers, marketplaces need to disrupt themselves before LLMs do it for them.

It’s going to be a tumultuous few years for marketplaces as the guard changes between Google and the LLMs. Customer acquisition dollars will shift fast, and then LLMs will come knocking for the whole profit pool.

But many marketplaces, particularly if they run the playbook above, are going to come out of it just fine.

Credits

Thank you to Casey Winters for his help on this essay. He is one of the top marketplace thinkers in the world and you should read his Substack.

OpenAI is already running into supply legibility problems. From The Information on January 11:

OpenAI’s plan to turn its chatbot into a seamless shopping destination is off to a slow start. Despite the high-profile September announcements involving Shopify and Stripe, the “in-app checkout” for millions of shops hasn’t quite arrived. It turns out that teaching an AI to understand the chaotic world of merchant product data—where “in stock” might actually mean “pre-order”—is a massive technical hurdle.

This is something Google has been trying to solve for many years, and they recently launched an update for the AI era with their Universal Commerce Protocol.

It’s a hard problem and one of the reasons that a big walled garden with an internally consistent protocol like Amazon is so much more seamless for customers.

There is an unlikely but possible scenario in which marketplaces don’t have a choice on whether or not to play ball, because agents can just transact on their site or app without their permission.

Amazon’s lawsuit against Perplexity claims they can’t. From their statement:

“We think it’s fairly straightforward that third-party applications that offer to make purchases on behalf of customers from other businesses should operate openly and respect service provider decisions whether or not to participate. This helps ensure a positive customer experience and it is how others operate, including food delivery apps and the restaurants they take orders for, delivery service apps and the stores they shop from, and online travel agencies and the airlines they book tickets with for customers.

Agentic third-party applications such as Perplexity’s Comet have the same obligations, and we’ve repeatedly requested that Perplexity remove Amazon from the Comet experience, particularly in light of the significantly degraded shopping and customer service experience it provides.”

Most likely Amazon will win, or at least get more protection than they have today. The major players like ChatGPT are already operating as if they do need permission, working only with companies for which they have a direct partnership.

This is the assumption marketplaces should be operating under until proven otherwise.

Excellent article. The time for thin marketplaces is over. Go deep and make your experience AI native while you still can. Assume LLMs will become formidable at much of what you do so you aren't surprised later if they do get there.

Great 2*2s for framing the problem